Publicado el: Abril 5, 2025 | Perspectivas de la industria & Datos prácticos para productores y compradores

Si ha estado involucrado en la fabricación de metales., construcción, o cadenas de suministro industriales en los últimos años, Una cosa es imposible de ignorar: los precios del acero han subido.. No solo un poco. En algunos casos, Los precios de determinados productos laminados han subido más de 50% desde temprano 2021. Pero, ¿qué es lo que realmente impulsa esto?? Y lo más importante, ¿Cómo es el laminado de acero adaptación del sector?

No se trata sólo de números en una hoja de cálculo. Detrás de cada precio hay una compleja cadena de decisiones de producción, actualizaciones de equipos, costos de energía, y cambios en la demanda global. En esta inmersión profunda, analizaremos datos del mundo real, Examinar las tendencias actuales en frío y calor. laminado de acero, explorar cómo están respondiendo las fábricas, y brindarle información útil ya sea que esté obteniendo material, ejecutando un molino, o diseñar maquinaria.

¿Por qué están aumentando los precios del acero?? El panorama general

El aumento de los precios del acero no se produjo de la noche a la mañana. Comenzó con una tormenta perfecta:

- Aumento de los costos de las materias primas: mineral de hierro, carbón de coque, y los precios de la chatarra se dispararon a nivel mundial debido a las limitaciones de suministro y al aumento de los costos de minería.

- Recuperación global después de los cierres pandémicos: Mientras las fábricas reabren en Europa, América del norte, y Asia, demanda de acero estructural, hojas automotrices, y los componentes industriales aumentaron.

- Inflación energética: Los laminadores consumen mucha energía. Con los precios de la electricidad y el gas natural subiendo, especialmente en Europa y China, Los costos operativos aumentaron significativamente..

- Cuellos de botella logísticos: Contenedores de envío, transporte ferroviario, y los retrasos en los puertos agregaron semanas a los tiempos de entrega y elevaron los costos de transporte..

Pero mientras todo el acero se ha encarecido, no todos los segmentos se ven afectados por igual. Ahí es donde laminado de acero entra en juego: es parte del problema y parte de la solución.

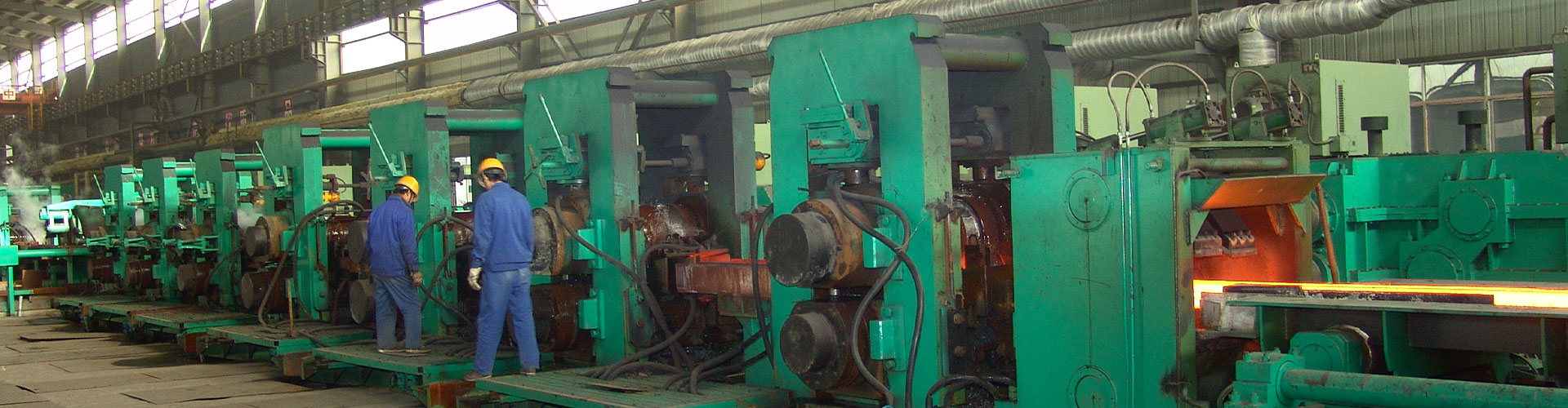

Cómo funciona el laminado de acero: Un repaso rápido

Antes de sumergirnos más profundamente, aclaremos lo que laminado de acero en realidad significa. Es el proceso de dar forma a las palanquillas de acero., losas, o florece en productos terminados o semiacabados como platos, verja, rieles, bobinas, y secciones mediante rodillos de alta presión.

Hay dos tipos principales:

Rodillo caliente

El acero se calienta por encima de su temperatura de recristalización. (normalmente alrededor de 1.100°C) y pasó por rodillos. Utilizado para vigas estructurales., refugio, pisos anchos, y platos pesados.

Laminado en frío

Realizado a temperatura ambiente sobre bobinas laminadas en caliente.. Produce tolerancias más estrictas., superficies más lisas. Común en automoción, accesorios, y piezas de precisión.

La elección entre frío y calor influye en el coste, fortaleza, acabado superficial, y aplicación final. Comprender estas diferencias ayuda a explicar por qué algunos productos experimentaron aumentos de precios más pronunciados que otros.

Tendencias de precios reales: Qué muestran los datos (2021–2025)

Para entender el impacto, He aquí un vistazo a los precios promedio de mercado de productos clave de acero laminado en las principales regiones.. Todos los valores son por tonelada métrica. (Dólar estadounidense).

| Tipo de producto | Región | Q1 2021 promedio ($/tonelada) | Q1 2023 Cima ($/tonelada) | Q1 2025 Actual ($/tonelada) | Cambiar (%) |

|---|---|---|---|---|---|

| Bobina laminada en caliente (CDH) – 3mm | Porcelana | $680 | $1,420 | $980 | +44% |

| HRC – 5 mm | EE.UU | $720 | $1,560 | $1,050 | +46% |

| Bobina laminada en frío (CDN) – 1,0 mm | UE | $810 | $1,680 | $1,120 | +38% |

| Refugio (Calificación 60) | India | $590 | $1,020 | $740 | +25% |

| Hoja Galvanizada (soldado americano) – 0,5 mm | Promedio mundial | $870 | $1,750 | $1,200 | +38% |

Fuentes de datos: Asociación Mundial del Acero, Grupo CRU, Boletín de metales, informes de intercambio nacional (Actualizaciones del primer trimestre). Nota: Los precios varían según el tamaño del pedido., condiciones de entrega, y contenido de aleación.

El cambio de lo crudo a lo preciso: Cómo se están adaptando las fábricas

Uno de los mayores cambios en los últimos años ha sido el paso de exportar acero al carbono básico a producir acero de mayor valor., productos laminados de precisión. Esta tendencia es especialmente clara en países como China e India., donde las políticas gubernamentales ahora limitan las exportaciones de acero bruto pero fomentan la fabricación con valor agregado.

Por ejemplo:

- Muchos grandes laminadores han mejorado sus líneas de laminador de bandas en caliente con control de espesor automatizado (AGC), sistemas de refrigeración mejorados, y mejores cámaras de inspección de superficies.

- Las unidades de laminación en frío están añadiendo molinos de nivelación de tensión y de paso superficial para mejorar la planitud y las propiedades mecánicas para uso automotriz..

- Las fábricas especializadas más pequeñas están invirtiendo en laminación de banda estrecha para nichos de mercado como los sistemas de montaje solar., Conductos de climatización, y laminaciones de motores eléctricos.

Esta transición no es barata. Una modernización completa de una línea de laminación en caliente de tamaño mediano puede costar desde $30 millones a $80 millón, dependiendo del nivel de automatización y la capacidad. Pero la recompensa se traduce en mejores tasas de rendimiento., menor uso de energía por tonelada, y acceso a precios premium en los mercados de exportación.

Eficiencia energética en líneas modernas de laminación de acero

Con energía que representa hasta 25% del coste total de producción en algunas plantas, Las mejoras de eficiencia ya no son opcionales.. Así es como los laminadores de nueva generación están reduciendo el uso de energía sin sacrificar la producción.

| Actualización de tecnología | Energía ahorrada (kWh/tonelada) | Período de recuperación de la inversión | Mejor para |

|---|---|---|---|

| Accionamientos regenerativos en molinos reversibles | 45–60 kWh | 2.5–4 años | Molinos en frio, placa rodante |

| Calentamiento por inducción de alta eficiencia (para recalentar) | 80–100 kWh | 3–5 años | Precalentamiento de la palanquilla antes del laminado |

| Control automatizado de espacio entre rollos + Predicción de IA | 20–30 kWh | 1.5–3 años | Todos los molinos continuos |

| Recuperación de calor residual de hornos | equivalente a 50 kWh térmico | 4–6 años | Grandes plantas de laminación en caliente |

Estas no son ideas futuristas: se están implementando ahora mismo en fábricas de toda Turquía., Corea del Sur, y el sudeste asiático. Incluso los operadores más pequeños están alquilando kits de actualización modulares que incluyen sensores inteligentes y cajas de computación de vanguardia para monitorear el desgaste de los rodillos y predecir las necesidades de mantenimiento..

Qué significa esto para los fabricantes de equipos y proveedores de servicios

Si construye o da servicio laminado de acero maquinaria, este período de transformación presenta oportunidades reales. Las fábricas no sólo están reemplazando piezas rotas: están repensando flujos de producción completos.

Aquí es donde la demanda está creciendo:

- Rectificadoras de rodillos de precisión: Necesario para mantener una precisión a nivel de micras en los rodillos de trabajo utilizados en el laminado en frío..

- Sistemas de inspección de superficies en línea: Cámaras y software de IA que detectan grietas, rayones, o escalar defectos en tiempo real.

- Unidades rodantes de filtración de aceite.: Esencial para mantener una lubricación limpia en molinos en frío en tándem.

- Sistemas de guía personalizados: Reduzca el desgaste y la desalineación durante el laminado de barras y varillas a alta velocidad..

Un fabricante en Alemania informó de un 70% aumento de pedidos de laminadores en frío reversibles compactos entre 2022 y 2024 — principalmente de mercados emergentes que buscan producir sustitutos locales de las láminas para automóviles importadas..

Ya sea que dirija un taller de fabricación o obtenga materiales para proyectos de construcción, Aquí hay pasos prácticos para gestionar los crecientes costos y riesgos de suministro.:

- Asegurar contratos a largo plazo cuando sea posible. Algunas fábricas ofrecen acuerdos de precio fijo durante 6 a 12 meses si se compromete a volúmenes mínimos..

- Considere grados alternativos. Para aplicaciones no críticas, cambiar de ASTM A36 a Q235 o S235JR puede ahorrar entre un 8 % y un 12 % sin comprometer el rendimiento.

- Optimizar patrones de corte. Trabaje con su procesador para reducir los desechos. Incluso un 3% la mejora en el rendimiento se suma rápidamente a los precios actuales.

- Explorar proveedores regionales. El transporte de acero a largas distancias aumenta los costes. Las miniacerías locales que utilizan hornos de arco eléctrico suelen tener precios más estables.

- Monitorear el inventario de cerca. Evite las compras de pánico. Utilice pronósticos continuos y existencias de reserva solo para artículos críticos.

Mirando hacia el futuro: ¿Hacia dónde se dirige el laminado de acero??

La era de lo barato, La abundancia de acero puede haberse acabado, al menos por ahora. Pero eso no significa estancamiento. De lo contrario, La presión para innovar nunca ha sido tan fuerte..

Durante los próximos cinco años, espera ver:

- Más adopción de gemelos digitales para simulación y optimización de laminadores.

- Mayor uso de de alta resistencia y baja aleación (HSLA) Aceros que permiten espesores más finos y estructuras más ligeras..

- Crecimiento en redes de miniacerías utilizando chatarra reciclada y energía renovable.

- Una integración más estrecha entre los trenes de laminación y las líneas de recubrimiento o formado posteriores para reducir la manipulación y la logística..

La función central de laminado de acero permanece sin cambios: transforma el metal en bruto en formas utilizables. Pero como se hace, que tan eficientemente, y qué tan sostenible definirá qué empresas prosperarán en la próxima década.

Reflexiones finales para los actores de la industria

El aumento de los precios del acero no ha sido fácil. Son márgenes reducidos, decisiones difíciles forzadas, y debilidades expuestas en las cadenas de suministro. Pero también es un progreso acelerado..

Las fábricas que alguna vez retrasaron las actualizaciones ahora se están moviendo rápidamente. Los ingenieros están encontrando formas más inteligentes de utilizar la energía y los materiales.. Los compradores son cada vez más estratégicos. Y los fabricantes de equipos están avanzando con soluciones que ofrecen retornos reales..

En el centro de todo esto está el laminado de acero proceso: sigue siendo uno de los eslabones más vitales del mundo industrial. Ya sea que esté produciendo bobinas para torres eólicas o tiras de precisión para dispositivos médicos, comprender las fuerzas que dan forma a este sector le brinda una ventaja.

Mantente informado. Mantente flexible. Y siga centrándose en la calidad y la eficiencia, porque esos valores importan más que nunca..